1.3

Russian military industry

The Russian military-industrial complex has significantly increased its production in response to the prolonged war against Ukraine and can likely supply the armed forces with the necessary artillery ammunition and armoured vehicles to continue its aggression.

Russia's advantage over Ukraine in terms of available artillery ammunition will likely continue to grow in 2024 unless Western countries can quickly step up the production and delivery of artillery ammunition to Ukraine.

While the Russian Armed Forces will increasingly depend on an ageing and less capable fleet-of-armour due to losses in Ukraine, restoring armoured vehicles from long-term storage can offset the losses for several more years.

The Russian Armed Forces’ inability to realise the Kremlin’s imperialist ambitions in Ukraine within the initially planned timeframe in early 2022, coupled with the resilient Ukrainian resistance to the invasion, has led to significant losses for Russia not only in terms of personnel but also in military equipment. The need to compensate for equipment losses and to produce the required artillery ammunitionWe are using the OSCE definition of artillery ammunition, which includes ammunition for tanks, howitzers, mortars, and multiple launch rocket systems (MLRS) with a calibre of 100 mm and above.[1] to sustain the conflict in Ukraine has posed a serious challenge to the Russian military-industrial complex (MIC).

ARTILLERY AMMUNITION

The main factors influencing Russia’s decisions regarding the need to ensure the availability of ammunition for continuing aggression in Ukraine are as follows:

- Ammunition stockpiles. Before the invasion, Russia had a massive stockpile of artillery ammunition in its depots and warehouses, primarily inherited from the overinflated armed forces of the Soviet Union. It is estimated that this reserve amounted to approximately 20 million shells and rockets, much of which has expired. Depending on the condition of the expired ammunition, a portion of it can be restored for use through industrial inspection, refurbishment and repair processes.

- Ammunition consumption. The consumption of artillery ammunition by the Russian Armed Forces has significantly changed over the course of the war. While during the spring 2022 offensive, daily consumption reached up to 60,000 units, by the second half of 2023, it mostly remained within the range of 10,000 to 15,000 units. Nevertheless, the Russian Armed Forces have at their disposal three to four times more ammunition per day than the Ukrainian forces. Since the beginning of the invasion, Russian troops have used an estimated 12 to 17 million units of artillery ammunition in Ukraine.

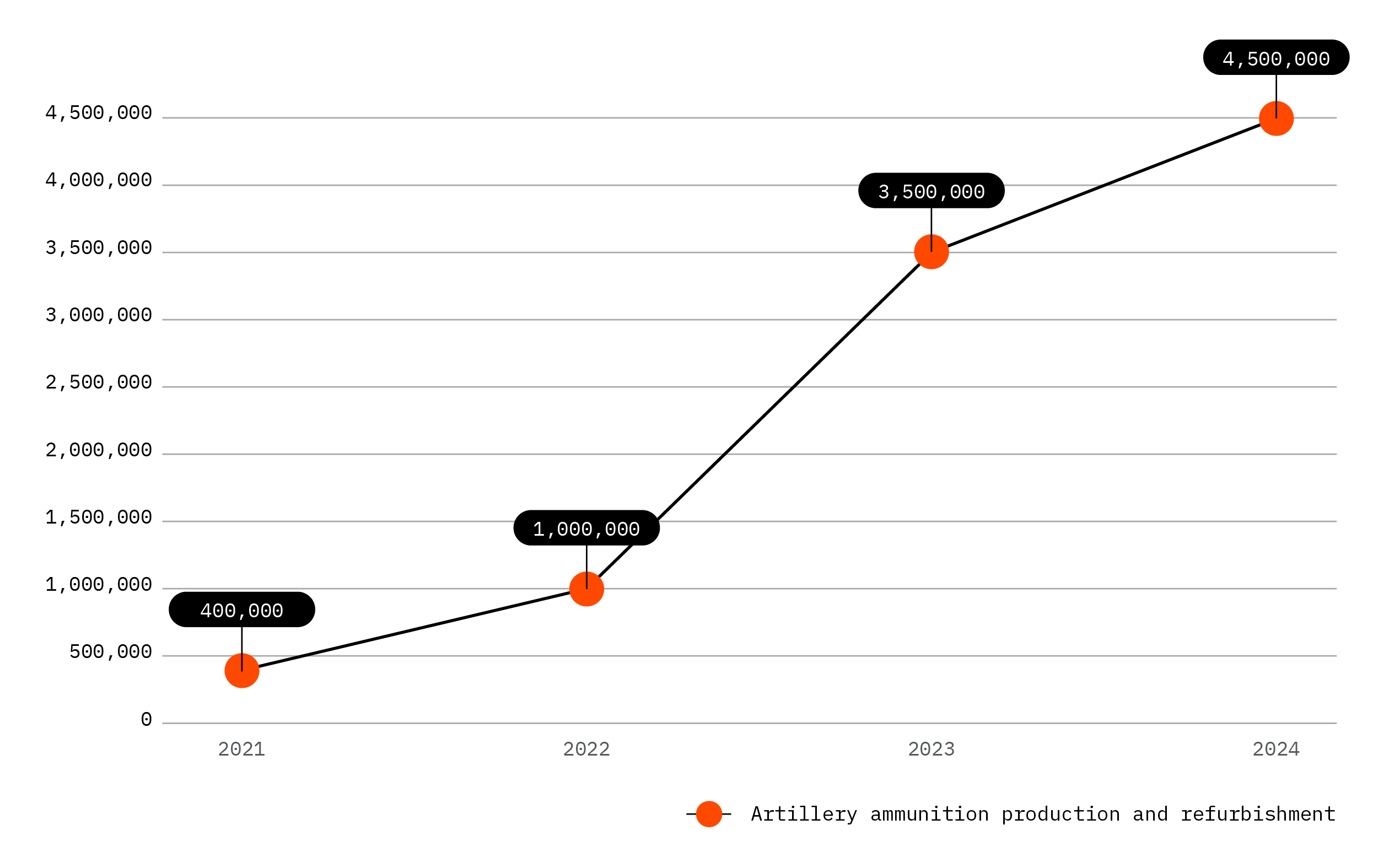

- Ammunition production. Before the invasion, in 2021, Russia produced new artillery ammunition and refurbished obsolete stockpiles, amounting to nearly 400,000 units per year. In 2022, Russia’s production of new artillery ammunition alone reached approximately 600,000 units, roughly equivalent to the combined output of the United States and European Union member states.

Since the summer of 2022, Russia has made serious efforts to increase artillery ammunition production. In collaboration with the defence ministry, Russia’s MIC has mapped production capacities, identified production bottlenecks and implemented measures to reduce their impact. As a result, the defence ministry approved and backed financing for MIC investment plans to increase production volumes significantly in 2023. Despite the restrictive impact of Western sanctions on the acquisition of factory equipment and machinery, as well as the chronic shortage of qualified labour in Russia’s MIC, it managed to multiply its production of artillery ammunition in 2023. The production and refurbishment of artillery ammunition reached 3 to 4 million units in 2023, far exceeding the quantity available to Ukraine.

In 2024, Russia will likely deplete the stocks of suitable artillery ammunition for refurbishment in its depots and warehouses. Consequently, the main burden of supplying artillery ammunition to the armed forces will rest on producing new ammunition. The MIC’s efforts to increase production will continue, including attempts to acquire Western industrial equipment through various sanctions-avoidance schemes involving intermediaries from third countries. Meanwhile, Ukraine relies on ammunition imported from Western countries, where the growth in production capacity compared to Russia’s MIC is significantly slower. Therefore, it is almost certain that Western ammunition deliveries to Ukraine in 2024 will not be able to keep pace with the supplies available for the Russian Armed Forces. The gap in available artillery ammunition between Ukraine and Russia is expected to widen even more in 2024.

ARMOURED VEHICLES

The Russian Armed Forces have lost exceedingly high numbers of armoured vehicles (tanks, infantry fighting vehicles, personnel carriers and self-propelled artillery) since the beginning of the invasion. As of January 2024, the losses included over 2,600 tanks, 5,100 armoured personnel carriers and 600 self-propelled artillery units. To compensate for the losses, Russia has turned to its inventory of armoured vehicles in long-term storage, primarily the thousands of units inherited from the Soviet military. Some of these have been modernised in recent decades and reintroduced into the Russian Armed Forces. However, most of this inventory is both decaying and technically outdated, with the oldest units having degraded over the decades to a point where restoring their combat capability may not be possible or practical.

Due to the rapid accumulation of losses in Ukraine, the focus of the Russian MIC has shifted towards repairing battle-damaged armoured vehicles, and the production of new equipment is largely giving way to refurbishing equipment from long-term storage.

Due to the rapid accumulation of losses in Ukraine, the focus of the Russian MIC has shifted towards repairing battle-damaged armoured vehicles, and the production of new equipment is largely giving way to refurbishing equipment from the long-term storage. The MIC repurposes components from preserved vehicles for the repair of battle-damaged ones or for the restoration of stored equipment. This approach will likely enable every third or fourth preserved weapon system to be restored to combat readiness. Therefore, President Putin’s publicly announced plan to restore 2,000 old tanks by 2026 may well be feasible. While refurbishing preserved armoured vehicles can be seen as a stopgap measure to ensure the Russian Armed Forces’ armoured capability during periods when the MIC may be unable to replace lost weapon systems with new ones, this practice is likely to remain relevant in the medium term of 5 to 10 years.

The primary challenges in tank production and refurbishment include a shortage of components and their fluctuating quality, as well as a shortage of qualified labour in the Russian defence industry. Significantly improving production quality under international sanctions is likely unrealistic even in the medium term. While sanctions have limited the Russian MIC’s access to high-quality components, especially machine tools, production lines and factory equipment, Russia continually seeks ways to circumvent sanctions through third countries, particularly China and Hong Kong. In the short term, the MIC is likely incapable of significantly expanding the production of new armoured vehicles. Nevertheless, refurbishing preserved armoured vehicles from storage can compensate for losses in Ukraine for several more years. As losses continue to mount in Ukraine, the Russian Armed Forces will increasingly depend on an ageing and less capable armoured fleet but, in terms of sheer numbers, will maintain their armoured capability.